- #Bluetooth credit card reader quickbooks for free

- #Bluetooth credit card reader quickbooks android

- #Bluetooth credit card reader quickbooks software

- #Bluetooth credit card reader quickbooks Offline

- #Bluetooth credit card reader quickbooks plus

A starter mobile card reader is available free for low-volume businesses.

#Bluetooth credit card reader quickbooks for free

PayPal is offering its Chip and Swipe card reader, normally $25, for free until June 30, 2020. PayPal Here is designed for businesses that accept credit card transactions at a variety of venues such as events, retail spaces, or even offices. Square promises to deliver your funds within one to two business days. To accept chip card payments and contactless payments like Apple Pay or Google Pay, you can purchase the $49 reader outright or pay three monthly $17 installments for the Bluetooth-enabled, battery-powered device. The mobile POS service app helps with inventory management, facilitates multiple user access, and features personalized email receipts, a tipping interface for retail and service businesses, and more.

#Bluetooth credit card reader quickbooks Offline

An offline mode lets you pay the same flat processing fee as swipes, in case of a power outage.

#Bluetooth credit card reader quickbooks plus

Square doesn’t charge monthly or hidden fees and it has the same processing fee for all major credit cards: 2.6% plus $0.10 per swipe, dip, or tap, 3.5% plus $0.15 for each keyed-in transaction, and 2.9% plus $0.30 for each invoice or e-commerce transaction.

When you set up an account with Square you get a free Magstripe card reader.

#Bluetooth credit card reader quickbooks android

Square accepts all major credit cards and works on iPhone, iPad, and Android mobile devices via its free companion point-of-sale app for iOS and Android. While it may not be the absolute cheapest to use, it is easy to understand and set up, affording small companies the flexibility to add other hardware services if needed. Square is one of the most popular, versatile, and user-friendly mobile credit card readers on the market. Here are some of the best mobile credit card readers for small businesses: Square These contactless systems include primarily Apple Pay, Google Pay, and Samsung Pay.

NFC payments are extremely swift and secure and do not involve credit cards, since credit information is embedded in the customer’s mobile wallet. Mobile wallets use NFC (Near Field Communications) technology that allows wireless (contactless) payments between smartphones and card readers.

#Bluetooth credit card reader quickbooks software

Customers are increasingly using their smartphones for retail transactions with built-in mobile wallet software linked to their credit cards. Mobile wallets: Not only are people leaving their cash at home, they’re leaving their wallets there too.

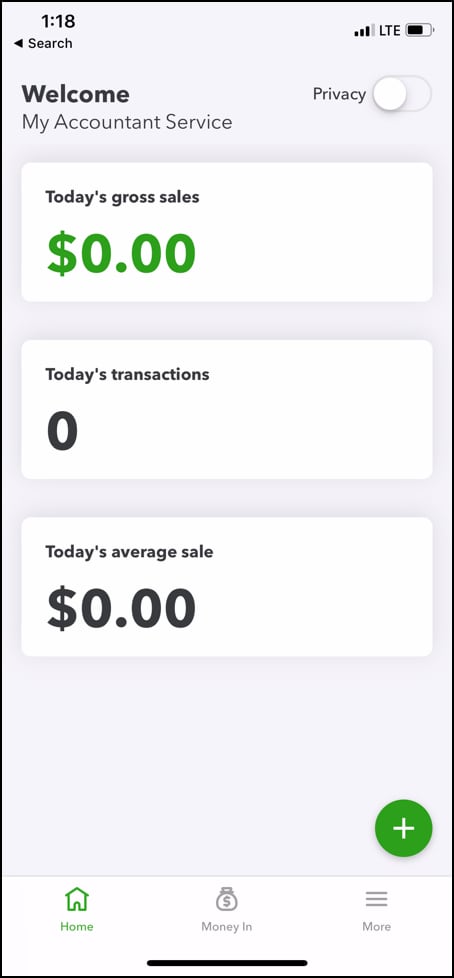

Upgrading to an EMV chip card reader is necessary because if there is in-store fraud, merchants - not credit card companies - are now liable for the theft if they do not have a chip-enabled reader available. The EMV chip card, developed and managed by American Express, Discover, JCB, Mastercard, UnionPay, and Visa is more secure than the older magnetic stripe swipe technology because it uses fresh encryption for every sale. Beware of plans that emphasize per-transaction fees: They can get expensive - especially if your business hosts numerous inexpensive transactions.įrom the outset, make sure your business and your credit card reader are equipped to handle chip cards and mobile wallets, as well as older magnetic stripe credit cards, by purchasing an advanced device that can accept EMV (chip card) and NFC (contactless) payments.ĮMV chip cards: Staying up to date doesn’t only mean the easiest and cheapest solution - it means the solution that’s going to help your customers buy your product or service in the most convenient and secure hassle-free way. These devices connect with mobile apps on the back end to provide extensive merchant and customer services. Small companies have a choice of reasonably priced mobile card readers - some even come free - that they can purchase outright or pay for through monthly plans. A mobile card reader serves as the electronic link connecting merchants with an mPOS system that’s designed to allow a simple swipe or tap to accept credit and debit card payments for purchases. A POS system runs on your mobile device using software to process transactions, just like a traditional POS terminal. Mobile point-of-sale systems can be used anywhere and function independently of elaborate merchant services. Read on as we take a closer look at the top mobile card readers on the market, including devices that can handle chip cards and touchless payments like Square, PayPal Here, and more.

0 kommentar(er)

0 kommentar(er)